This note is occasioned by Elizabeth Warren’s recent proposal on corporate governance—to add labor representation on corporate boards and expand the scope of corporate responsibility. Regardless of what happens to her bill, she has done an important service by calling attention to a fundamental problem.

In recent decades American business has been taken over by the so-called Milton Friedman view of corporations. That view has a simple prescription for how companies should operate: the world is best-served when businesses focus exclusively on business. I.e. the role of a corporation should be to generate the maximum possible return to its investors. Any other concerns (the workforce, community responsibility, etc.) are a perversion of the engine that makes capitalism great.

There are lots of reasons why that is suspect. Clearly in this world labor has little to say, and in fact even a business’ own interests are not necessarily well-served—investors can walk away if the business gets pillaged for their benefit. The percentage of business profits returned to investors has gone up dramatically with this philosophy, to the disadvantage of both labor and capital investment in the companies themselves.

The point we want to emphasize here is how damaging the Milton Friedman view is in the environment of today. We have just passed a massive tax cut that has taken so much out of the federal budget that there is (particularly with the deficits) essentially nothing left for the other problems of the society. As justification we’re told that private enterprise is the engine that makes everything great.

That is of course a logical trap. Businesses in this world have no responsibility for the well-being of the country—and the government doesn’t either, because the private sector is always the answer!

As a consequence we’re not investing in our people, we don’t have to think about their welfare, and we’re not preparing for the future, because there is no one on the hook to do it. Even Adam Smith had no illusions about the private sector’s ability to police itself or prepare the population for personal and national success.

Everyone should recognize the true symbolism of the following chart:

The one significant result of the tax cuts is the huge surge in stock buybacks, essentially returning taxpayer money to corporate investors. We set a record in Q1, and then almost doubled it in Q2!

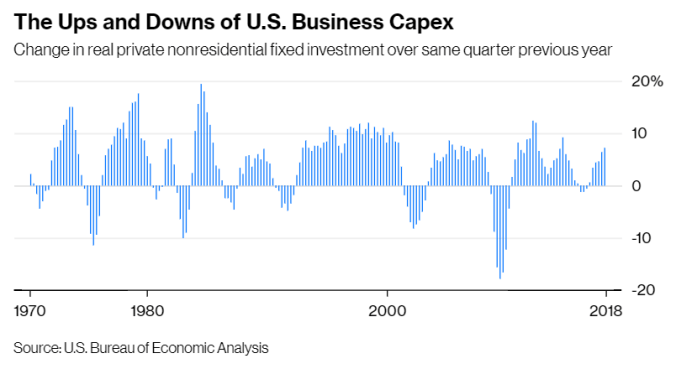

Capital investment, by contrast, was relatively flat—little touched by all that money:

In other words the tax cuts have siphoned off the resources of the country, so that there is nothing left for issues like education, infrastructure, the opioid crisis, climate change—and has delivered that money to corporations who have in turn just passed it through to their wealthy investors via buybacks.

So we’ve become like one big predatory private equity investment, being sucked dry for the benefit of the happy few who are running the show.